The card also has a high salary requirement of S$80,000 per year which limits accessibility. Travel insurance, airport lounge access, limo transfers, golfing privileges are more are among the privileges not included. Also, while the card does have several benefits, it lacks travel perks and privileges that might be important to some consumers. Secondly, its general rewards rates are low at 0.4 miles for S$1 local spend and 1.2 miles for overseas spend. First, its upsized shopping rewards are limited only to online, while competitors reward online, offline, local, and overseas purchases. There are a few drawbacks to DBS Woman's World Credit Card. Overall, the plan is best for shoppers who can pay back their purchase within the 6 months. Each terminated instalment plan will have a early termination fee off S$150. Also, cancellation of this card would result in termination and immediate payment for all on-going instalment plans financed by the card. In addition, such purchases are not eligible to earn rewards. Purchases must be made from their list of merchant offers, which may vary in terms and conditions. However, there are a few things to keep in mind about this payment plan. This feature is particularly great for shoppers who tend to overspend or who prefer to pay over time. One of the card's most unique features, however, is the 0% Interest Payment Plan, which splits purchases into 0% interest instalments for up to 24 months. Consumers can also enjoy up to 10% cashback on accomodation bookings. In addition, cardholders have access to complimentary gifts and discounts of up to 20% on select beauty, wellness and fashion merchants. Online spend is rewarded with 10X DBS points (or 20 miles) per S$5. What Makes DBS Woman's World Card Stand OutĭBS Woman's World Card offers frequent online shoppers a great way to maximise rewards for their spend and pay for purchases in flexible, interest-free instalments over up to 24 months.

spend of S$800 within 60 days of card approval to be eligible

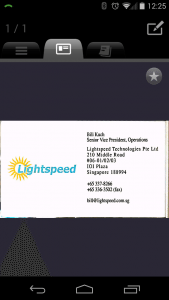

#Worldcard mobile review code

Enter the promo code 150CASH and make a min.New DBS/POSB cardmembers can get S$150 cashback.DBS Woman's World Credit Card Features and Benefits Shoppers who can meet this annual spend and who prefer to pay for purchases over instalments might find DBS Woman's World Card to be a great fit for their lifestyle. This means that for the average spender, DBS Woman's World Card may easily become a no-fee card. Nonetheless, the annual fee of S$194.4 is waived the first year and is subsequently waived with every annual spend of S$25,000. Local spend earns just 1X DBS points or 2 miles per S$5, and overseas spend earns 3X DBS points or 6 miles. While cardholders can also enjoy benefits like discounts on rental cars, DBS Woman's World Card is less valuable for non-shoppers. However, one of its best attributes is the 0% Interest Payment Plans, which allows shoppers to pay for purchases over 6 months with 0% interest. The card also offers consumers discounts and gifts in beauty, wellness, and fashion. Cardholders earn 10X DBS points or 20 miles per S$5 online shopping spend. DBS Woman's World Card maximises rewards for online shoppers and is perfect for consumers who prefer to pay for their purchases in instalments.

0 kommentar(er)

0 kommentar(er)